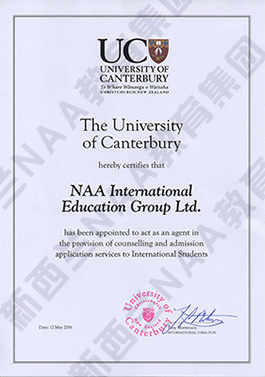

坎特伯雷大学/The University of Canterbury

- 课程名称:

会计Master of Commerce in Taxation and Accounting

- 课程级别:硕士学位/Master's Degree(9级)

- 课程代码:

- 学费:$42,700 NZD Per Year

- 学分:

- 开学时间:16-July-2018

- 申请截止:

- 授课校区:The University of Canterbury

- 课程信息:

- demonstrate in-depth knowledge and understanding of contemporary thought and developments within your specific research area

- evaluate the implications of your own research findings for the wider body of relevant academic literature

- synthesise academic literature and communicate research findings, both orally and in written form, consistent with academics working in your chosen discipline.

- Bachelor of Commerce

- Bachelor of Arts

- Bachelor of Science in Economics or Finance, Computer Science or Management Science

- or a bachelor's degree and relevant graduate diploma.

Course details

Summary

Taxation is a core area within the broader fields of accounting and law, drawing together concepts from these disciplines, with those from economics. More recently, knowledge and theories in a number of other disciplines, such as psychology and sociology, have been applied to assist with a greater understanding of the impact of taxation on society.

Chartered Accountants Australia and New Zealand recognise the importance of studies in taxation, with courses containing taxation content included in their ‘core' and ‘accounting and/or business related' academic requirements. Studying taxation will equip you with the skills and knowledge to become a taxation specialist within the accounting profession, a commercial professional or a chartered accountant.

A Master of Commerce degree will allow you to learn more about your chosen subject area, critically view the world and carry out an independent piece of research. These knowledge, skills and competencies mean MCom graduates are well-prepared for professional roles and business consulting.

If you have been following the New Zealand Institute of Chartered Accountants (NZICA) programme (now the Chartered Accountants of Australia and New Zealand), study in the MCom programme counts as one year of professional experience.

The Master of Commerce graduate

As an MCom graduate you will be able to:

Qualification structure

The Master of Commerce degree consists of 180 points of which between 90-120 points is coursework (between six and nine courses), and a 90-point thesis or a 60-point dissertation.

Further study

UC offers a Doctor of Philosophy in a number of commerce subjects.

Career opportunities

As a specialist in Taxation and Accounting you will be able to enter a variety of organisations. For example, as a taxation specialist or accountant in chartered accounting firms, accountancy practices, government organisations (including Inland Revenue and the Treasury), business and commercial enterprises, non-profit organisations, banking and financial services, management consultancies, education organisations, law firms and obtain interesting, well-paid work around the world.

Many Taxation and Accounting students aspire to become chartered accountants through Chartered Accountants Australia and New Zealand, CPA (Australia) or the Association of Chartered Certified Accountants (ACCA).

Entry criteria

Students must have completed one of the following:

Prerequisites vary between majors, but normally good grades in 300-level courses in the subject concerned are required.

Other English language requirements: TOEFL PBT with a minimum score of 575 and TWE with a minimum score of 4.5; CCEL EAP Level 2 with a minimum B+ grade; CAE or CPE score of 176 with a minimum of 169 in reading, writing, listening and speaking; Pearson Test of English (Academic) - PTE with an overall score of 64 and no PTE communicative skills score below 58.

= 新西兰小学申请问题集 =