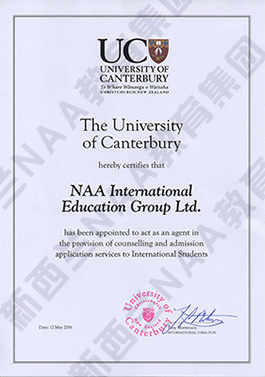

坎特伯雷大学/The University of Canterbury

- 课程名称:

会计PhD - Doctor of Philosophy in Taxation and Accounting

- 课程级别:博士学位/Doctoral Degree(10级)

- 课程代码:

- 学费:$7,440 NZD Per Year

- 学分:

- 开学时间:16-July-2018

- 申请截止:

- 授课校区:The University of Canterbury

- 课程信息:

Course details

Summary

Taxation is much more than interpreting and applying legislation. Societies need taxation in order to redistribute wealth, to provide for expenditure on public goods and services, as well as serve as a tool to influence behaviour.

Taxation is a core area within the broader fields of accounting and law, drawing together concepts from these disciplines, with those from economics. More recently, knowledge and theories in a number of other disciplines, such as psychology and sociology, have been applied to assist with a greater understanding of the impact of taxation on society.

Chartered Accountants Australia and New Zealand recognise the importance of studies in taxation, with courses containing taxation content included in their ‘core' and ‘accounting and/or business related' academic requirements. Studying taxation will equip you with the skills and knowledge to become a taxation specialist within the accounting profession, a commercial professional or a chartered accountant.

The UC Doctor of Philosophy (PhD) is a research-only degree carried out under expert supervision and using world-class facilities.

A PhD involves extensive, sustained and original research and study in your chosen subject, with the results being presented in a thesis that will contribute to intellectual knowledge of the field. It is a mark of intellectual ability, self-discipline and commitment. A PhD prepares you for a number of careers, including as an academic.

The minimum period of enrolment for a full-time candidate is two years and the maximum period four years; most PhD students take between three and three-and-a-half years.

Career opportunities

As a specialist in Taxation and Accounting you will be able to enter a variety of organisations. For example, as a taxation specialist or accountant in chartered accounting firms, accountancy practices, government organisations (including Inland Revenue and the Treasury), business and commercial enterprises, non-profit organisations, banking and financial services, management consultancies, education organisations, law firms and obtain interesting, well-paid work around the world.

Entry criteria

Enrolment in a PhD requires completion of a research-focused honours or master's degree at first-class or second-class division 1 level (or equivalent qualifications). Applicants with qualifications from outside New Zealand must have been granted admission to the University.

Other English language requirements: TOEFL PBT with a minimum score of 575 and TWE with a minimum score of 4.5; CCEL EAP Level 2 with a minimum B+ grade; CAE or CPE score of 176 with a minimum of 169 in reading, writing, listening and speaking; Pearson Test of English (Academic) - PTE with an overall score of 64 and no PTE communicative skills score below 58.

= 新西兰小学申请问题集 =